How Can Trade Carbon Credits Be Traded?

Trade Carbon Credits

Carbon credits are a way to reduce greenhouse gas emissions. They can be purchased and used by individuals and companies to offset their greenhouse gas emissions. This allows non-green companies to operate carbon-neutral. The price of these credits depends on the volume of credits traded.

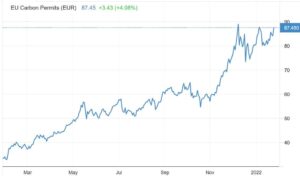

The market for buy carbon credits is increasingly popular with companies looking for ways to hedge their financial risks. The number of industries in the sector is increasing, and more are setting net-zero goals. A recent study estimates that the price of carbon credits will increase tenfold in the next decade.

Carbon credits are available from a wide variety of projects, but most are created through forestry and agricultural practices. In addition to reducing greenhouse gas emissions, these projects typically generate co-benefits for the community. If the project meets certain standards, it can be traded at a premium.

How Can Trade Carbon Credits Be Traded?

There are several options for trading these credits, ranging from direct sale to trading through a middleman. One way is through a carbon-credit ETF, which is the most readily accessible and easy way to invest in the carbon market. You can buy and sell these ETFs through a brokerage account. Most brokers receive a commission for arranging the transactions.

Another option is to purchase carbon credits directly from a carbon capturer. You can also obtain carbon credits through the voluntary market. Although the voluntary market is not regulated by the government, there are certain rules to be followed.

These include a registry system, independent audits, and a series of methodologies. There are also standard products and non-standardized products. Standard products guarantee the basic specifications of the project and are preferable to traders and end buyers. Non-standardized products allow end buyers to inspect the underlying projects and are more likely to avoid accusations of greenwashing.

Carbon projects can be created by national governments, or they can be managed by private groups or organizations. Community-based projects are usually localized, while industrial projects are generally larger-scale. Industrial projects are often easier to validate as they are more likely to produce large volumes of carbon credits.

Creating a carbon market requires promoting scarcity and limiting the right to emit. To create this market, countries set a quota on their own emissions, as well as those of other businesses. Countries then either auction or offer free permits to companies in the industry. Once a country meets its quota, it can sell excess units to other countries or sell them at the international market.

Companies that reduce their carbon emissions can trade these extra permits for cash. This allows companies to earn a profit, and it can help to offset the costs of implementing climate change initiatives. However, there are some companies that are years away from reducing their emissions substantially.

As a result of the global climate crisis, there is more interest in creating and trading carbon credits. This has led to an increase in the size and complexity of the carbon market, which is not only made up of a diverse range of buyers and sellers, but also various types of projects.